02.14.12

Posted in Financials, Inmarsat, LightSquared, Operators, Regulatory, Spectrum at 4:59 pm by timfarrar

So this evening the NTIA has released the reports on the latest LightSquared GPS interference testing, along with its recommendation to the FCC that “LightSquared’s proposed mobile broadband network will impact GPS services and that there is no practical way to mitigate the potential interference at this time”.

The FCC has responded to this letter with an even more devastating statement as follows:

“To drive economic growth, job creation, and to promote competition, the FCC has been focused on freeing up spectrum for mobile broadband. This includes our efforts to remove regulatory barriers that preclude the use of spectrum for mobile services. To advance these goals, the Commission runs open processes – the success of which relies on the active, timely, and full participation of all stakeholders.

“LightSquared’s proposal to provide ground-based mobile service offered the potential to unleash new spectrum for mobile broadband and enhance competition. The Commission clearly stated from the outset that harmful interference to GPS would not be permitted. This is why the Conditional Waiver Order issued by the Commission’s International Bureau prohibited LightSquared from beginning commercial operations unless harmful interference issues were resolved.

“NTIA, the federal agency that coordinates spectrum uses for the military and other federal government entities, has now concluded that there is no practical way to mitigate potential interference at this time. Consequently, the Commission will not lift the prohibition on LightSquared. The International Bureau of the Commission is proposing to (1) vacate the Conditional Waiver Order, and (2) suspend indefinitely LightSquared’s Ancillary Terrestrial Component authority to an extent consistent with the NTIA letter. A Public Notice seeking comment on NTIA’s conclusions and on these proposals will be released tomorrow.

“This proceeding has revealed challenges to maximizing the opportunities of mobile broadband for our economy. In particular, it has revealed challenges to removing regulatory barriers on spectrum that restrict use of that spectrum for mobile broadband. This includes receivers that pick up signals from spectrum uses in neighboring bands. There are very substantial costs to our economy and to consumers of preventing the use of this and other spectrum for mobile broadband. Congress, the FCC, other federal agencies, and private sector stakeholders must work together in a concerted effort to reduce regulatory barriers and free up spectrum for mobile broadband. Part of this effort should address receiver performance to help ensure the most efficient use of all spectrum to drive our economy and best serve American consumers.???

Unsurprisingly, it appears that Chairman Genachowski wanted to get this issue off his plate before testifying to Congress on Thursday. It now seems the next steps will be a Public Notice, which may request comment on the terms of reference for a future receiver/interference standards proceeding, followed by a proceeding stretching well beyond the November 2012 election. Even if that resulted in a favorable ruling, the NTIA letter highlights that “lower 10″ operations would not be phased in for many years (2020 or beyond), which as I’ve indicated previously makes it extremely unlikely that it would be worthwhile preserving the current Cooperation Agreement with Inmarsat.

Indeed, with Inmarsat poised to claim another $56.25M from LightSquared early next week, and the 90 day bankruptcy window for challenging the $40M paid to Inmarsat in November expiring on Thursday this week, a decision may need to be reached on how to proceed very soon. With LightSquared set to run out of money in the near future, the company must now consider whether to file for bankruptcy and preserve its resources for the inevitable litigation fights, or continue pretending that all of these problems can be overcome while its cash drains away.

It seems that even if LightSquared does continue to pretend that all is well (and remember that LightSquared’s relentlessly optimistic/deluded CEO told the FT only a few days ago that he was confident the FCC would “do the right thing” and approve the network), then its debtholders will certainly assert that the FCC’s action means a MAC has occurred under the first lien debt covenants. However, it remains unclear whether that event would occur upon release of the FCC’s Public Notice tomorrow, or only when a final Order is issued, which may not take place for several months.

Permalink

Posted in Regulatory, Spectrum at 1:51 pm by timfarrar

Today AT&T has put up a blog post asserting both that “wireless data volume on our network continues to double annually” and that “over the past five years, AT&T’s wireless data traffic has grown 20,000%”. However, those statements can’t easily be reconciled with AT&T’s previous pronouncements in March 2011, when AT&T presented statistics claiming that traffic had grown by 8000% over the four years from 2007 to 2010 (because 20,000% growth in five years would imply ~150% growth in 2011).

However, even more importantly, AT&T’s blog post is somewhat at variance with their assertions to investors that traffic is currently growing at ~40% annually, as I noted in a story for GigaOm on Saturday.

So what’s the actual answer here? One factor appears to be that AT&T’s blog post is apparently obfuscating the issue by changing its definition from “mobile data” (in March 2011) to “wireless data” (in the current blog post). In other words, AT&T’s WiFi offloading (at Starbucks, Times Square, the Superbowl, etc.), which is helping to drastically reduce the growth of (on-network) “mobile data” traffic, is presumably now included in their statistics.

Another factor is that AT&T claims the 40% growth was only intended to represent the increased usage of existing smartphone users, and the smartphone penetration expanded from 42.7% to 56.8% during 2011 (a 33% increase, so if all subscribers, including new ones, increased their individual usage by 40% then this would equate to 86% overall usage growth).

The best way to reconcile AT&T’s apparently contradictory statements would be to conclude that on-net mobile data was 8000% (of the end 2006 number) at end 2010, and including WiFi offload it was 10000% of this level. In other words WiFi offload was 20% of total AT&T wireless data traffic. At the end of 2011 total traffic was 20000% of the end 2006 number, and during 2011 AT&T has stated that WiFi traffic tripled. Thus, it seems reasonable to assume that WiFi offload was ~6000% of the end 2006 number and on-net mobile data was ~14000% of the end 2006 number. In other words, on-net mobile data traffic volumes grew by ~75% (not 100%) in 2011 and ~30% of AT&T’s overall traffic was on WiFi.

As a cross-check, AT&T indicated that there were ~200M WiFi sessions on its network in Dec 2011, and if the above analysis is correct, there would have been about 9PB of WiFi data transmitted and received. That’s 45MB per session, which doesn’t sound too far off when “hotel locations account for approximately 45 percent of the total AT&T Wi-Fi network traffic”. However, unless and until we see some more specifics on data volumes for AT&T’s cellular network (separate from its WiFi network) it will be very hard to be certain just what the growth of on-network traffic really is.

Regardless, AT&T’s 40% traffic growth per user is far less than the 86% CAGR in data usage projected by Cisco today for US smartphone and tablet users between 2011 and 2016. For comparison, 40% CAGR for five years is about 5x growth in traffic, whereas 86% CAGR is equivalent to 22x growth in traffic per user.

Permalink

Posted in Regulatory, Spectrum at 12:34 pm by timfarrar

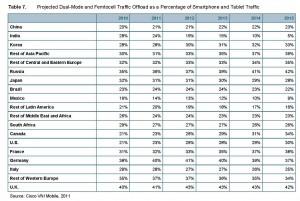

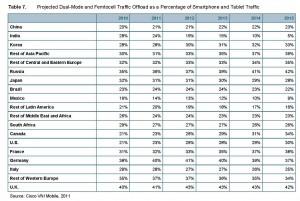

So the latest version of Cisco’s VNI mobile data traffic forecasts has been released today, and yet again Cisco are predicting a “data deluge“. However, there appears to be huge uncertainty in their forecasts due to the impact of data “offloading” (to WiFi and fixed broadband networks). As others have noted, Cisco “heavily downplays” the role of WiFi in future networks, and has gone so far as to drop the table in its Feb 2011 report which depicted the amount of offloading they projected by country for tablets and smartphones.

In the 2012 report Cisco also confuses the matter by referring to the large amount of “fixed and WiFi traffic” associated with “portable devices” (meaning laptops and WiFi-only tablets). However, it is still possible to get hold of some equivalent information on the offloading assumptions from the 2012 forecast by use of the VNI mobile forecast tool on Cisco’s website which states that:

23% of the United States’s mobile data traffic was offloaded in 2011.

37% of the United States’s mobile data traffic will be offloaded in 2016.

49% of the United States’s handset/tablet mobile data traffic was offloaded in 2011.

46% of the United States’s handset/tablet mobile data traffic will be offloaded in 2016.

Though the first two assumptions appear at first sight to be broadly comparable with Cisco’s 2011 assumptions, in reality the comparison should be lines 3 and 4 giving the handset/tablet traffic. In Feb 2011 Cisco apparently believed that US smartphone/tablet users offloaded 21% of traffic in 2010, and that this would increase gradually to 30% of traffic in 2015. Now Cisco appears to believe something completely different, that almost half of mobile data traffic is offloaded, but that is set to decrease in the future. So was Cisco just drastically wrong in their assumptions about offload last year? Is that why they are trying to hide the change in assumptions? What basis did Cisco have for these assumptions last year and today – are they based on real measurements of offloading or just guesswork? And just how much credence can we give to their current offload assumptions?

Of course, the offload assumption is a primary driver of Cisco’s future traffic growth projections because smartphones are expected to account for the majority of future data usage:

In the United States, smartphone mobile data traffic will grow 41-fold from 2011 to 2016, a compound annual growth rate of 110%.

In the United States, smartphone mobile data traffic will reach 1,047,312 Terabytes per month in 2016.

In the United States, smartphones will be 60% of total mobile data traffic in 2016, compared to 24% at the end of 2011.

In the United States, the average smartphone will generate 4,524 megabytes of mobile data traffic per month in 2016, up 2,146% from 201 megabytes per month in 2011, a CAGR of 86%.

Simply put, Cisco needs to do a much better job of justifying its offloading assumptions and stop trying to hide the ball. GigaOm has highlighted that WiFi and offloading more generally are likely to be key themes for the wireless industry in 2012, and while this forecast may help to sell more boxes and provide fuel for the spectrum crisis narrative, Cisco is not doing its credibility any favors. As Henry David Thoreau wrote: “If you have built castles in the air…now put the foundations under them”.

Permalink

02.12.12

Posted in Financials, Inmarsat, LightSquared, Operators, Regulatory, Spectrum at 5:48 pm by timfarrar

With apologies to Private Eye, it seems like everyone is trying to grab as much of LightSquared’s cash as they can, while there is still some left in the bank, and run away before they get sued. I’m told that Inmarsat is poised to assert completion of its Phase 1 transition (freeing up two 2x5MHz blocks of spectrum, known as 5L and 5H) on February 18, which would entitle it to a payment of $56.25M. In addition, it appears that the spectrum blocks used for augmentation signals by Starfire’s precision GPS receivers will be moved in late March (though it should be noted that this shift does nothing to protect these receivers from experiencing interference if LightSquared was ever to begin terrestrial operations).

However, once this relocation has taken place, Inmarsat should also be able to claim completion of the Phase 1.5 transition by April 1 (freeing up the lower 2x10MHz block, known as 10L) under the April 2011 amendment to the Cooperation Agreement, which I’m told would entitle it to another very substantial sum of money (many tens of millions of dollars) over and above the $40M already paid. This is an additional cash outlay that I had not considered in my previous estimates of LightSquared’s cashflows, and although it is not enough in itself to exhaust LightSquared’s remaining cash resources, it certainly could be another potential hit to the ultimate recovery for LightSquared’s creditors (unless they can recover this money via the lawsuits that will inevitably be filed against Inmarsat and other parties at a later date).

UPDATE (2/14/12): I’m told that Starfire will be relocated to somewhere in the 1536-1544MHz spectrum block, implying that Inmarsat’s focus is on strict compliance with the terms of the Cooperation Agreement (so they can claim more money from LightSquared), rather than on creating a long term solution for these users (which would involve placing the augmentation downlinks close to the top of the band around 1559MHz). That’s unsurprising because Inmarsat emphasized previously, in a confidential June 2010 letter to the FCC (included in the recent FOIA production), that they would only be doing the work LightSquared paid them to do, and nothing else.

At the House Aviation Subcommittee hearing last Wednesday, it was indicated that the NTIA’s report and recommendations would be transmitted to the FCC “shortly”, and although the report was not released on Friday evening, it seems all but certain that we should hear more this week, potentially followed very quickly by an FCC ruling to initiate an interference/receiver standards proceeding. The testimony of Mr. Porcari, Deputy Secretary at the Dept of Transportation, and co-signatory of the Jan 13 Excom letter could not have been more clear in stating that “[The Obama Administration has] concluded that [LightSquared's] current plan to provide such services adversely affect GPS signals” and “LightSquared’s proposals are fundamentally incompatible with GPS use”, so it now seems that the FCC will be bound to indicate that LightSquared will not be permitted to build and operate a terrestrial network for the foreseeable future.

However, the precise language of this ruling will be critical in establishing whether a Material Adverse Change has occurred under LightSquared’s debt covenants. With Inmarsat apparently intent on securing as much money from LightSquared as it possibly can in advance of a bankruptcy filing, and no chance of a favorable ruling from the FCC, LightSquared’s creditors will now presumably be keeping their fingers crossed that in the very near future they have the chance to assert that an event of default has occurred, and stop LightSquared’s cash from draining away, perhaps even before the next payment is made to Inmarsat on February 18.

Permalink

02.07.12

Posted in LightSquared, Operators, Regulatory, Spectrum at 10:18 pm by timfarrar

So the Looney Tunes cartoon (think Wile E. Coyote) that has been LightSquared over the last year appears to have finally run its course, with LightSquared today effectively conceding defeat by asking the FCC to initiate what will inevitably be a multi-year receiver standards proceeding (followed by an even longer transition period for any such standards to come into effect). Today’s press conference was called at very short notice and appears to have happened in response to the impending release of the NTIA’s report and recommendations, which are also likely to call for an investigation into potential future receiver standards and indicate that LightSquared should not be allowed to operate its terrestrial network in the meantime.

Rather than waiting until March for comments on LightSquared’s Petition for Declaratory Ruling, the FCC now appears determined to clean up any loose ends and get this issue off its plate as soon as next week, before Congressional hearings into the procedures it followed in granting the LightSquared waiver get underway. Indeed the FCC Chairman stated after the Public Notice was issued on Jan 27 that the Petition for Declaratory Ruling would not affect the timeline for the FCC’s next steps. It therefore wouldn’t be unreasonable to suppose that LightSquared may have been given a strong hint that by asking for a receiver standards proceding themselves they could avoid a harsher ruling from the FCC mandating such a proceeding.

Of course, the FCC may also be looking to deflect attention from its own release of some documents in response to the numerous Freedom Of Information Act requests that have been filed. Buried in this release are numerous damaging documents which raise questions about the apparent coordination of LightSquared’s November 2010 waiver request with FCC staff prior to it being filed (and incidentally disclose LightSquared’s pricing plan of $6 per Gbyte for terrestrial capacity and $10 per Mbyte for satellite capacity, as well as the overall planned system capacity of 2800 Tbytes per hour terrestrially and 100 Gbytes per hour via satellite) which led to it being put out for comment immediately. It is also unclear whether this meeting with LightSquared on November 16 was disclosed in any ex parte filing. Indeed LightSquared had also been discussing with the FCC a change to their business plan to only launch one satellite, which has never been disclosed publicly (except in one accidental comment that I blogged about at the time).

However, potentially even more damaging are documents related to the conditions imposed on LightSquared (then SkyTerra) as part of the Harbinger transfer of control proceeding which led up to the FCC Order in March 2010. As part of these conditions, SkyTerra agreed not to lease spectrum or more than 25% of its network traffic to AT&T and Verizon, which met with a furious reaction from those two companies, who described this restriction as “manifestly unwise and potentially unlawful“. After AT&T and Verizon filed petitions for reconsideration, enquiries from Congress prompted the FCC Chairman to write a letter asserting that these were “voluntary commitments [Harbinger] made” (as opposed to something the FCC imposed). That was always a very suspicious assertion, given it is hard to see why Harbinger would have wanted to limit its ability to do a deal with AT&T or Verizon.

The FCC’s FOIA releases in fact confirm that Paul de Sa at the FCC appears to have initiated the discussion of conditions “on build out and wholesale agreements…to ensure the public interest benefits of the build out” in November 2009 and he apparently was responsible for drafting the written version of these conditions (in an internal FCC meeting) after meeting with Harbinger (again apparently with no ex parte filing) and persuading them to sign off in late January 2010. With this background now revealed, its hardly surprising that Sen. Grassley has a lot of questions he wants to ask, which presumably should relate not only to the January 2011 waiver, but also to the March 2010 transfer of control.

Permalink

01.27.12

Posted in Financials, ICO/DBSD, LightSquared, Operators, Regulatory, Spectrum, TerreStar at 2:23 pm by timfarrar

Today, the complexities of both the LightSquared and DISH regulatory processes both got even more messy. In the DISH waiver proceeding, AT&T filed an ex parte submission urging the FCC to impose buildout conditions on DISH similar to those imposed on LightSquared (260M POPs within 5 years 9 months), rather than any financial clawback to address the increase in value of the spectrum that a waiver would produce. AT&T also asks for conditions to be imposed on DISH’s 700MHz spectrum in line with the conditions imposed on AT&T’s recent purchase of spectrum from Qualcomm.

This submission is a blatant attempt by AT&T to put a thumb on the scales, as the FCC weighs up the appropriate balance between buildout mandates and clawback of any windfall. The reason for AT&T’s action at this very late stage in the process appears to be that DISH is trying to play off AT&T’s prospective bid against a potential venture with MetroPCS. MetroPCS would certainly be unwilling to commit to a 260M POP buildout, so if the FCC conceded AT&T’s demands, they would be the only game in town and DISH would lose its leverage in price negotiations. We’ll find out soon enough if AT&T’s gambit succeeds, but few would bet against Charlie Ergen’s poker playing skills after the events of the last year.

In the even more complex LightSquared process, the FCC has today issued a Public Notice establishing a Pleading Cycle in respect of LightSquared’s December 2011 Petition for Declaratory Ruling, which sought to establish that GPS receivers were not entitled to interference protection. This Pleading Cycle, with comments due by Feb 27 and replies by March 13, almost certainly pushes back an FCC ruling on the LightSquared testing into the second half of March, because the FCC would want to deal with all of these issues simultaneously. As a result, attention is now likely to be focused around April 1 (appropriately enough All Fools Day), when LightSquared is due to make the next interest payment on its debt and another ~$30M payment to Inmarsat.

The most intriguing issue in the Public Notice is the FCC’s subtle attempt to decouple the resolution of GPS interference from LightSquared’s January 2011 waiver, suggesting that any provision of the “terrestrial portion of service” is subject to the “Interference-Resolution Process” which “to date…has not been completed”:

On January 26, 2011, the International Bureau granted LightSquared Subsidiary LLC (a subsidiary of LightSquared Inc., hereinafter also referred to as LightSquared) a conditional waiver of the ATC “integrated service??? rule, thereby establishing certain conditions that LightSquared must meet before it can provide the terrestrial portion of service contemplated by its proposed integrated satellite and terrestrial 4G wireless network. The Conditional Waiver Order prescribed an Interference-Resolution Process by which LightSquared would work with the GPS community to resolve concerns raised about potential interference to GPS receivers and devices that might result from LightSquared’s planned terrestrial operations. As a condition of commencing such commercial operations, the Conditional Waiver Order required that this process first be “completed,??? a term defined as the point at which “the Commission, after consultation with NTIA, concludes that the harmful interference concerns have been resolved and sends a letter to LightSquared stating that the process is complete.???

The reason for this is because LightSquared has indicated that, in the event it was blocked from operating, it would withdraw the January 2011 waiver application and claim it had the right to operate a dual-mode (satellite-terrestrial) service under the conditions of the FCC’s 2005 rulings. While that might not be economically viable (or practical), the FCC would presumably then be forced to step in to protect GPS and thereby supposedly “infringe” on LightSquared’s claimed “property rights”. The Petition for Declaratory Ruling is also an attempt to eviscerate the interference protections contained in the 2005 rulings (referred to as CFR 25.255) and thereby make the supposed infringement of LightSquared’s rights all the more obvious.

Thus, from this Public Notice, it does appear that the FCC is at least cognizant of LightSquared’s legal strategy, and is likely (as I predicted) to ultimately rule that the Interference-Resolution Process should be prolonged (and extended to cover GPS receiver/interference standards) and that in the interim LightSquared will be prohibited from commencing any terrestrial operations. LightSquared is apparently contending that this wouldn’t constitute a MAC on its debt covenants, but I suspect that’s an argument some of the debtholders (including Mr. Icahn) will want to test in court.

All this makes for a very complicated set of legal arguments, but one additional piece of information did emerge today that sheds some light on the big picture of why it has been so hard for spectrum holders to monetize their assets, and why the FCC has come in for so much well deserved criticism. DSL Prime is reporting that growth in mobile data usage is running at less than half the level predicted by Cisco and that the FCC staff “demanded their name be taken off” the FCC’s October 2011 demand forecast, because they “didn’t believe the claims in this paper”. However, with so many gullible journalists and investors buying into the idea of a (manufactured) “spectrum crisis” rather than a “spectrum bubble“, perhaps its a bit less surprising that LightSquared has been able to raise over $2.5B of investment in the last 18 months.

Permalink

01.24.12

Posted in Financials, LightSquared, Operators, Regulatory, Spectrum at 8:53 pm by timfarrar

After some uncertainty, it appears that LightSquared’s debtholders are gradually coalescing around Mr. Icahn’s view that they should invoke the MAC clause in the debt covenants and force LightSquared into bankruptcy immediately after an unfavorable FCC ruling, assuming that comes in the next couple of weeks. The key reason for this would be that LightSquared is due to pay Inmarsat $56.25M on February 18 (18 months after LightSquared gave the Phase 1 notice to Inmarsat under their Cooperation Agreement) and that sum of money is potentially big enough to make a material difference to the ultimate recovery, assuming that a liquidation is the eventual outcome of the bankruptcy case.

As debtholders get increasingly angry about this debacle, it also seems that they are looking around for other people to sue. Interestingly, it was suggested to me that (in addition to Harbinger) one potential target would be UBS, because the extent of the GPS interference problems may not have been disclosed fully at the time of the $586M February 2011 debt offering (UBS were the arrangers for this loan).

I for one had already blogged about the potential extent of the GPS interference issues in January 2011, based on testing that I had been told about by a major equipment manufacturer. In that case the engineers were so astonished by LightSquared’s proposed power levels that they brought in their personal car and handheld GPS receivers and noted considerable interference many hundreds of meters away from the test transmitter. In particular, it was pointed out to me that third order modulation interference into the middle of the GPS band was essentially an unsolvable problem under LightSquared’s original 10L and 10H configuration.

As a result this company had already concluded that (at the very least) use of the upper band spectrum was infeasible, well before the loan was sold to investors, and it can hardly have been long after that before LightSquared started negotiating with Inmarsat over the revised spectrum plan which was signed on April 25. Indeed my discussions with many knowledgeable people in mid-March (at the Satellite 2011 conference) indicated that everyone (including people with connections to LightSquared) already believed that use of the upper band would never be feasible (Note: the Field of Dreams reference in this link is still my all-time favorite – so thanks again to the unnamed satellite industry executive who noted the Chisholm, MN connection).

Permalink

01.20.12

Posted in Financials, LightSquared, Operators, Regulatory, Spectrum, TerreStar at 5:24 pm by timfarrar

This evening Reuters is reporting that Mr. Falcone is examining “the potential for selling [LightSquared's] right to certain spectrum leases” to “raise cash for his financially strapped telecom start-up”. Those leases are presumably the 8MHz of 1.4GHz spectrum that LightSquared leases from TerreStar Corp and the 5MHz of spectrum at 1670-75MHz that is leased from Crown Castle. However, its hard to see how LightSquared could raise any meaningful amount when any buyer would have to take over the underlying lease obligations ($24M per year for the TerreStar spectrum and $13M per year for the Crown Castle spectrum) and there is no clear buildout plan for either band. Indeed LightSquared had not even planned to include the 1.4GHz spectrum in its LTE network, instead entering into an agreement with Airspan Networks in August 2010 under which Airspan would “exclusively market LightSquared’s 1.4 GHz wireless spectrum” to the utilities industry as “a comprehensive solution for Smart Grid and Smart Utility applications” (though with no visible success to date).

Other news emerging today is that I’m told the NTIA plans to release its report on the November 2011 testing next week, presumably accompanied (concurrently or very shortly thereafter) by its recommendations to the FCC. It appears that the NTIA will back the PNT Excom recommendations (most likely including that there should be no further testing at this time and that there should instead be a consultation on GPS receiver standards), and it could hardly do otherwise, given that the test procedures criticized by LightSquared were specified by NTIA in the first place. Remember also that last August Mr. Strickling believed LightSquared was “in Wonderland” in thinking it could move forward after the initial test results came out.

I’m also told that LightSquared is trying very hard to pressure the FCC to overrule the NTIA, and order that the high precision testing should start within the next two weeks. However, that hardly seems plausible given the political firestorm that would be ignited by a public disagreement between the FCC and NTIA. Messrs. Genachowski and Strickling will be in Geneva this weekend for WRC-12 and it sounds like they will be very busy trying to avoid that situation. As a result, we might well see the same outcome as in September, when the release of the NTIA letter was followed very quickly by an FCC response (which in that case was to adopt the NTIA recommendation). It definitely looks like next week will be a very busy one, so follow me on Twitter @TMFAssociates for all the latest information.

UPDATE (1/22): It appears that the NTIA recommendations letter will have to wait for Mr. Strickling to return from Geneva, so we may not see it until the week of Jan 30. I also now expect the FCC to order a (pretty lengthy) GPS receiver standards rulemaking, which will allow for further testing and debate on when the lower band spectrum might be useable for terrestrial services (think 2020 or thereabouts, though we won’t have any definitive transition timeline until 2013 or even 2014) and conveniently put off any decision until after the November election. Of course, because LightSquared will be unable to operate its terrestrial network in the meantime (almost certainly a MAC for its loan covenants), that will likely set off a major battle amongst the debtholders about what to do next, with Mr. Icahn likely to try and force LightSquared into bankruptcy in the near future, while some other debtholders might be more supportive of Mr. Falcone if they still believe he can see this process through.

Assuming that the FCC did agree with the NTIA and stated that it was prohibiting LightSquared from commencing terrestrial operations for the foreseeable future, the most interesting question will be the grounds for its legal authority in doing so. LightSquared has indicated that it would withdraw the waiver request in these circumstances, and that it believes this would render the condition (requiring GPS interference concerns to be resolved) imposed in the January 2011 order null and void. In that case, the FCC would probably have to fall back on the authority that the GPS industry (plus others such as CTIA) have asserted all along (and LightSquared has challenged, most recently in its Dec 2011 Petition for Declaratory Ruling), that CFR 25.255 (“If harmful interference is caused to other services by ancillary MSS ATC operations, either from ATC base stations or mobile terminals, the MSS ATC operator must resolve any such interference”) provides absolute protection against LightSquared being permitted to cause harmful interference. In that case we could expect to see LightSquared launch legal action very quickly, in line with the position adopted in its December petition.

Permalink

01.19.12

Posted in Financials, LightSquared, Operators, Regulatory, Spectrum at 9:21 pm by timfarrar

Last week I expressed the view that LightSquared’s new investors could very well prolong the fight between LightSquared and the GPS industry. However, signs are starting to emerge that the FCC might be more willing to act than I had anticipated, and rule against LightSquared, which would potentially create a Material Adverse Change (MAC) in LightSquared’s first lien debt covenants, allowing the new investors to force the company into bankruptcy, and wrest control from Harbinger. While I still believe that the end game will involve liquidation of the business (not to mention litigation against all and sundry), the current debt investors would certainly benefit if they didn’t have to wait until all of LightSquared’s money had been spent in advance of a bankruptcy filing.

What evidence is there of a shift? Firstly the FCC responded very quickly to LightSquared’s assertions that the recent testing was “bogus” with a statement that:

We are awaiting completion of recommendations from NTIA. As we have said from the outset, the FCC will not lift the prohibition on LightSquared to begin commercial operations unless harmful interference issues are resolved.

Of course that is not what the FCC has said from the outset. Last year they said the agency won’t let LightSquared activate its network “until harmful interference issues are resolved”. Though subtle, that is quite a change in position, and an acknowledgement that the interference issues might not be resolvable.

More importantly, today has seen the resignation of a second high ranking FCC official and now both Ed Lazarus and Paul de Sa, who apparently negotiated the deals with SkyTerra (in early 2010) and LightSquared (in late 2010/early 2011) are leaving the FCC at a time when Sen. Grassley is shortly expected to receive details of LightSquared’s communications with the FCC. Indeed these two officials also met with Mr. Falcone when he visited the FCC on January 4.

To misquote Oscar Wilde, to lose one official may be regarded as a misfortune, to lose both looks like carelessness. If (and I do mean if) there is something problematic to emerge from the communications between LightSquared and the FCC, then it would certainly help to defuse the ensuing political firestorm if the FCC had already acted on the recommendations of the NTIA (which I think will very likely follow those of the PNT Excom). Communications Daily is now reporting that the NTIA has received the full report from the PNT Excom and will now review it and “eventually” advise the FCC how to move on the issue. However, if high precision testing is not going to be undertaken in advance of formulating these recommendations, the FCC could be in a position to rule relatively soon.

Permalink

01.18.12

Posted in LightSquared, Operators, Regulatory, Spectrum at 12:15 pm by timfarrar

Well it seems like all LightSquared has left now is an attempt to claim that the US government is biased against it, representing a remarkable turnaround from this time last year, when most people thought that any favoritism was going in the opposite direction. However, it appears that LightSquared’s protests are going to have absolutely no effect, because all of their allegations about how the testing was not “fair and accurate” simply reflect the NTIA’s own mandates for how the testing should be conducted.

Firstly LightSquared claim that considering a 1dB interference degradation threshold was a sign that “the testing was rigged“. However, the NTIA Administrator, Lawrence Strickling, specifically set out in his memo of September 9 requiring this round of additional testing that:

We want to do what is necessary so that our recommendations to the FCC regarding cellular and personal/general navigation GPS receivers can be conclusive and final. To that end, I want to make it clear that our recommendations will be based on NTIA standard definitions and methodologies for assessing interference. We will not accept conclusions or analysis based on propagation models and other tools that depart from our standard methodologies.

Of course the “standard definition” as agreed for the June TWG report was 1dB of degradation, and it was only when LightSquared discovered that the June results were unfavorable that they came up (at the last minute) with their alternative proposal of allowing 6dB of interference degradation, which was never accepted by the NTIA.

Secondly, the Sep 9 letter requested that “that the test plan include a retest of the 10 devices that were shown by the TWG testing to be more susceptible to the lower 10 MHz scenario”. Thus it was at Mr. Strickling’s explicit request that the testing “deliberately focused on…devices that were least able to withstand potential interference”.

Finally the tests were “shrouded in secrecy” because they involved technical performance data on individual GPS devices which both the FCC and NTIA agreed to keep confidential. The same procedure was used in the first round of tests in order to avoid data being released on individually identifiable devices and it is far from clear what LightSquared is alleging was done differently this time. Indeed, with the most “susceptible” of the previously tested devices being included in the second round of tests, it would have been necessary to keep the list of tested devices confidential in order to avoid revealing which these “susceptible” devices were.

It therefore seems clear that by LightSquared’s definition Mr. Strickling himself would count as one of the “government end users [who] manipulated the latest round of tests to generate biased results”. That doesn’t seem like a recipe for success when you are asking the NTIA to “objectively re-evaluate this initial round of testing” and ignore the recommendations of the PNT Excom.

What I find even more surprising is that LightSquared was briefing its investors as recently as Tuesday last week that everything was “under control” with respect to interference, when their letter to Mr. Strickling on Friday Jan 13, after the PNT Excom letter was released, noted that:

LightSquared has communicated its concerns repeatedly to PNT EXCOMM, NPEF and Air Force Space Command throughout this process, both verbally and in correspondence. All of these concerns have been seemingly disregarded. As you are aware, we have also corresponded with your office to make sure you were advised as the process unfolded.

In addition, the letter states that the FAA had “unilaterally decided to suspend any further collaboration” with LightSquared. These two statements are very hard to reconcile with LightSquared’s briefing to investors that the interference issues were “under control”, which was the reason that new investors became involved with the company. As a result, these (and other) investors might now feel that its not only LightSquared’s (currently invisible) CEO who is lacking in credibility. There was certainly a rush for the exits yesterday, with prices on LightSquared’s first lien debt opening with a markdown of ~9 cents to 40-44 cents on the dollar, and then falling further to 38-42 cents during the day.

Permalink

« Previous Page — « Previous entries « Previous Page · Next Page » Next entries » — Next Page »